What happened?

The Ministry of Finance circulated a draft bill implementing the Government’s decision regarding the economic program, aimed at encouraging immigration to Israel and return to Israel through tax incentives. The purpose of the bill is to encourage new immigrants and veteran returning residents to immigrate to, or return to Israel from January 2026 onwards.

It is important to emphasize that this is a draft bill only, which has not yet been enacted into law, and therefore it may not be adopted, or may be adopted with changes from those reflected in the draft.

Who is it relevant to?

Individuals planning to immigrate to Israel in 2026, and their advisors.

Legislative background

According to the explanatory notes accompanying the draft, the proposed legislation is based on the growing manifestations of antisemitism worldwide, particularly following the outbreak of the “Swords of Iron” war, which may lead Jews to emigrate from their countries of residence. The purpose of the bill is to encourage potential immigrants and returning residents, particularly those belonging to higher socio-economic groups, to choose Israel as their destination.

Current legal framework

Under the current law, individuals who become Israeli residents for the first time, or veteran returning residents (individuals who have been foreign residents for ten consecutive years or more), are entitled to a tax exemption on income derived outside Israel from any source, or income derived from assets located outside Israel, as well as on capital gains from the sale of assets located outside Israel, for a period of ten years from the date they become Israeli residents. The current law does not provide an exemption for income generated in Israel, including income from personal exertion (active income from business, profession, or employment).

Substance of the proposed legislation

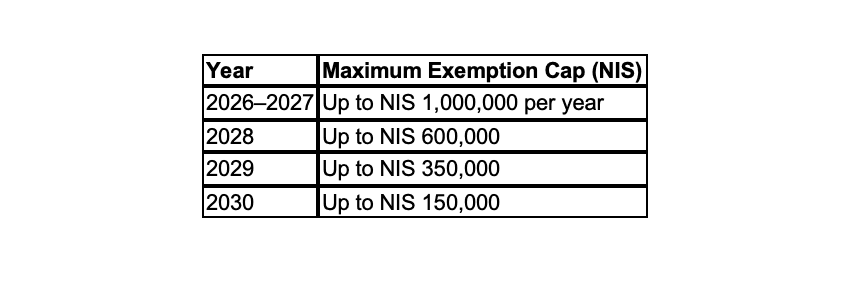

According to the draft, it is proposed to grant new immigrants and veteran returning residents a tax exemption on a portion of taxable income from personal exertion generated or derived in Israel, for a period of five years (2026–2030), subject to declining exemption caps over the years:

Any additional taxable income from personal exertion exceeding the exemption cap will be taxed according to the regular tax brackets. If enacted, the proposed exemption will be granted in addition to, and not in lieu of, the tax benefits currently available to new immigrants and veteran returning residents.

Conditions for eligibility

The draft sets out several conditions intended to ensure that the purpose of the incentive is achieved:

- Eligible individuals: The exemption will apply to new immigrants and veteran returning residents.

- Effective date: January 1, 2026.

- Type of exempt income: The benefit will apply to “Qualifying Income,” defined as income from personal exertion (active income) generated or derived in Israel.

- Source of income: The exemption will not apply to “Income from a Related Party”. However, the definition of “Related Party” does not include a company owned by the individual, in order to allow the benefit to apply to income generated through a company wholly owned by the individual.

- Income generated by multiple individuals: The explanatory notes clarify that where income is derived also from the activity of others, the exempt Qualifying Income will be granted proportionally, based on the portion attributable to the personal exertion of the eligible individual.

- Pro rata application for 2026: In 2026, the exemption cap will be applied on a pro rata basis according to the individual’s period of Israeli residency during that year.

How we can help?

We would be pleased to assist foreign residents considering immigration to Israel in 2026, by providing advice and guidance regarding the tax implications of relocating to Israel.

___

The above content is a summary provided for informational purposes only and does not constitute legal advice. It should not be relied upon without obtaining further professional legal counsel.